Trends of change in E-commerce: new reality supported by data

Without noticing, COVID-19 has sped up the shift the entire payment ecosystem has been expecting for years— only instead of a slow and gradual transition, many sectors were forced to condense an otherwise year-long process into just a couple of months. The surge in online commerce, contactless payment methods, digital wallets, and BNPL (buy-now-pay-later) schemes are the best representations of this changing landscape.

The new model of E-commerce is also unique in nature—not just speed. It reflects a very specific reality shaped by Covid-19; A newfound home-centric sphere that drives away most aspects of outdoor-leisure and travel, while simultaneously accelerating all things consumers can utilize indoors.

Trends reversed

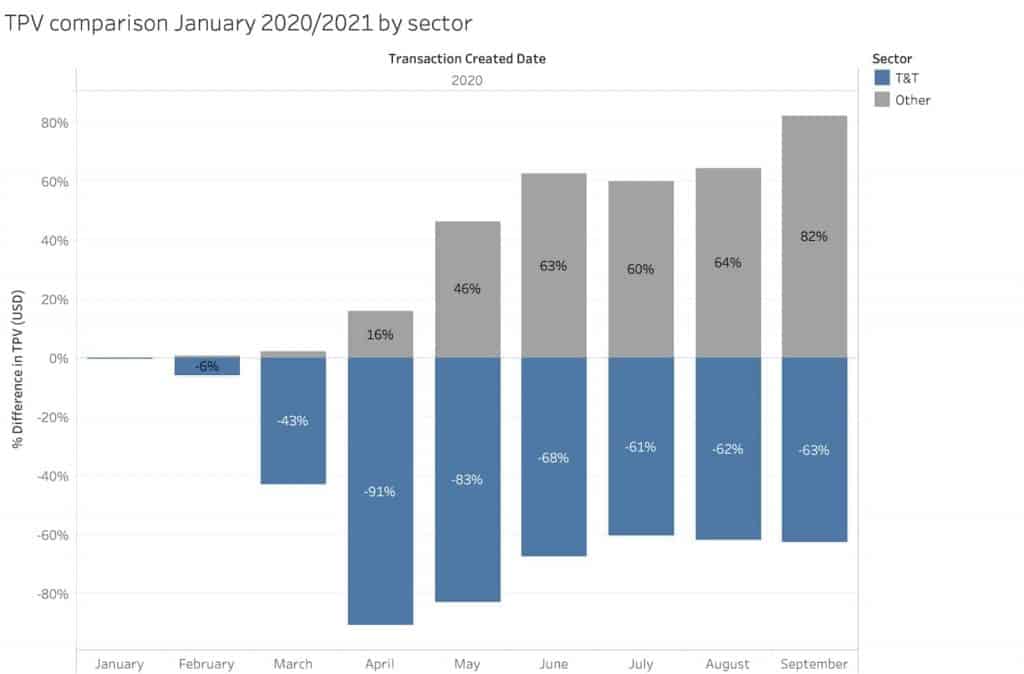

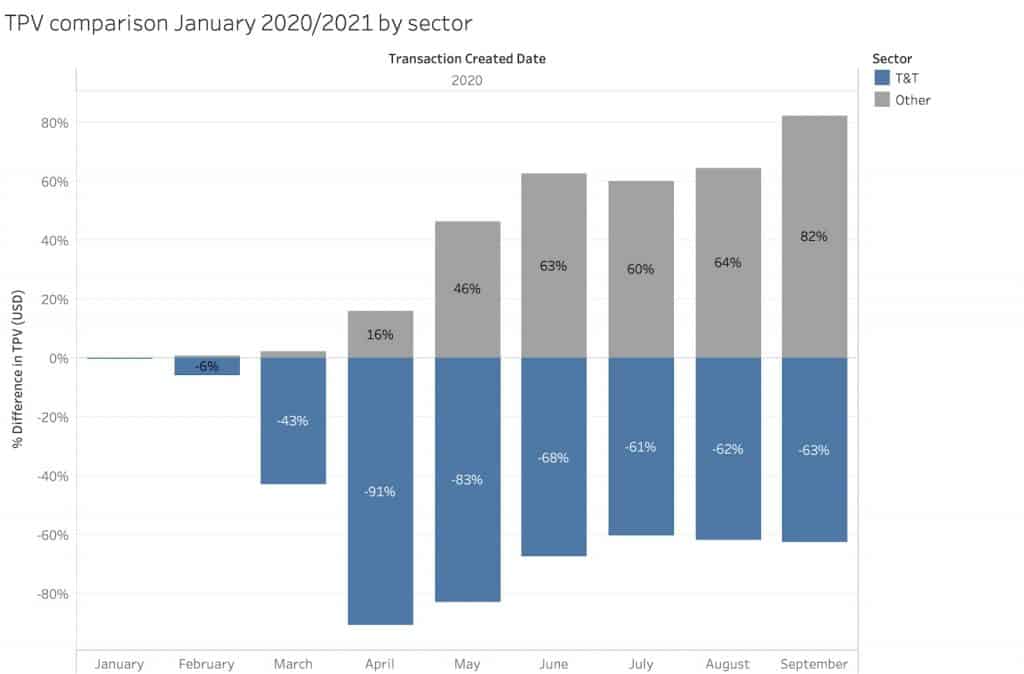

As consumers focus more on home-commerce, we witness how the scope of travel and transportation switch places with other sectors like apparel, leisure (that is non-outdoor-dependent), and more. This is all logical considering the new reality, but it is pretty staggering to see a trend pretty much turn around in mere several months. The graph below shows the gradual shift over the course of 8 months, from January 2020 to September 2020 (*T&T stands for Travel & Transport):

Does geography affect the rate of E-commerce penetration?

The answer is both yes and no.

Our data shows that E-commerce has grown on a global scale, i.e. it has been experiencing a big increase everywhere, and across all regions.

The relative jump is what makes the difference and emphasizes the gap between developing and developed countries, and a main aspect to this is their starting point and the relative jump they had to perform.

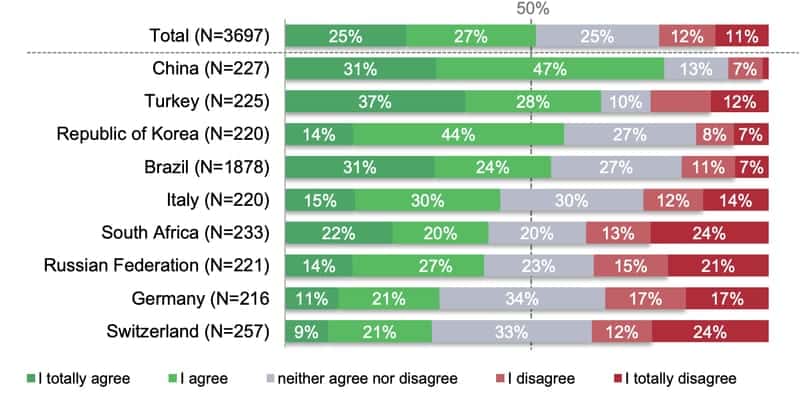

It therefore comes as no surprise that developing countries have shown the biggest relative jump into E-commerce as a result of Covid-19. LATAM and Africa (mainland) have been traditionally relying heavily on cash-payments and were left perplexed in light of the changing landscape. This fact pressed the need to act, and act fast. This phenomenon is also reflected in a survey conducted by the UNCTAD and its results are outlined below (respondents were requested to answer the question Since the outbreak of COVID-19, I am shopping more often online than before):

The need for Online payment solutions

The urgency to move a business online, whether they already have some online presence or not, requires adaptations, compliance with regulations, and the ability to perfect the customer experience and flow.

Many businesses are dumbfounded when they first need to set up a new payment infrastructure, considering that the process of accepting payments is not a plug-and-play solution. The purpose of gateways and orchestration solutions – like ZOOZ – can assist with the need to accept payments and build an infrastructure suitable for a sphere pushed so quickly into E-commerce.

A gateway helps businesses to build a stable, fortified, and flexible ground to build up from—whether they are new to the payment world or are already seasoned actors. Some solutions, like ZOOZ’s PaymentsOS, have make businesses’ lives easier by allowing them to easily add providers, A/B test them, set routing rules for optimization, and more.

Building from scratch or stepping up your game

We see a general division into two types of business-models which evolved as a result of the pandemic —the first are businesses that have already had a payment infrastructure of sorts in place, and the new reality just limelighted their need to expand and scale up their operation; and the second type is businesses new to the payment sphere, which now need to build their infrastructure from scratch. In either case, both models find themselves in need of making changes and adapting; and both can -and should- benefit from the orchestration abilities of gateway-solutions.

Moving forward

As the ripples of Covid-19 continue to hit every aspects of daily living, the payment ecosystem adequately evolves and adapts itself to cater new consumer preferences -both in the demand for certain commodities, and in their preferred methods of payment.

Either way, the linear increase of E-commerce is unlikely to cease in the near future, and we can expect to see a continuous global increase in its use on the expanse of the once popular in-store purchases. We can also expect to see the gap between developing and developed economies continuously decrease in the use of online payments.

Subsequently, the use of payment gateways, solutions, and supporting technologies also expand and grow, and businesses can benefit tremendously from strategically building their payment stack to support their current business needs, while also having in mind the post Covid-19 business reality, which has yet to unfold.