Failover Rules: Your Armour Against Downtimes

How do downtimes affect eCommerce?

No matter what product you are selling, your online store needs to have processes in place to ensure that you’re operational 24/7, to avoid possible revenue loss in case of downtime.

Downtimes happen to merchants constantly and are the most feared by events that businesses can experiences. Nowadays, businesses cannot afford to have downtimes, as these result in large amounts of wasted revenue on transactions that could have otherwise been completed.

Every second a merchant’s payments system is down can result in abandoned shopping carts, lost revenue, and reputational damage. For large retailers, such as Amazon.com, a mere one minute of downtime can mount to a staggering $220,318.80 loss.

Downtimes happen all the time

The eCommerce sphere is a gigantic space experiencing disruption almost every day, and companies need to fortify their payments as best as they can against possible downtimes. Payment providers are significantly affected by outages. A SafeCharge study found that 72% of retailers admitted to financial losses ranging from €10,000 – €100,000 per outage, with 11% citing losses of €1m or more. The reasons for outages are varied and can be caused by reasons such as data center downtime, technical errors, and more.

The answer? Failover rules

Some modern payment platforms equip merchants with the tools to fight the prospect of downtime. Failover rules, are one way to do that.

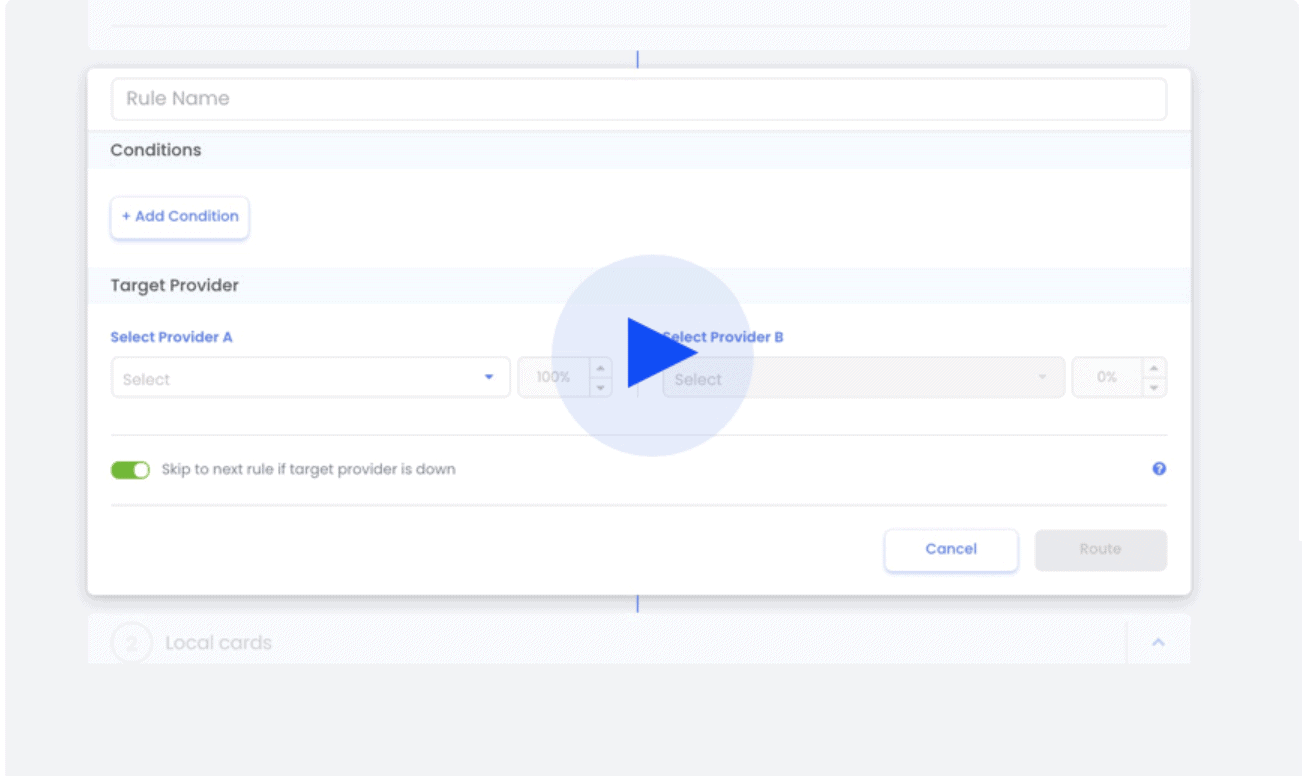

These rules are set to automatically route transactions from one provider to another, in case the first-choice provider is down.

At ZOOZ, we give you an overview of all of your providers and their current performances so you can spot if one of them is down or not. ZOOZ also allows you to set rules to re-direct payment to an alternate provider automatically in case one provider is down. The routing logic can be as simple or as complex as your business requires.

Here’s a short video to show you how easy it is to devise Failover Rules: