How localization affects your payments

Branching into new territories

Stepping into hypergrowth mode usually requires to think big.

Big means to expand into new markets and attracting more customers to increase profitability. eCommerce allows that to a large extent – its nature is to enable merchants to spread out to regions they haven’t operated in before, and to increase their spread with relative ease. There is a caveat to that statement though, a “catch”, if you will.

The downside of spreading is that even though you reach a multitude of people from different regions, enticing them to actually pay for the goods is not easy, and even if a customer is willing to make a purchase, there is still another obstacle to solve – offering the customer their preferred payment option to facilitate easy payment.

Local vs. Global

The world is constantly headed towards globalization, giving a false sense that everything is uniform no matter where you go. In reality, the payment world couldn’t be more fragmented. The global payment ecosystem shows a very different reality, one that has a tremendous effect on a company’s payment strategy.

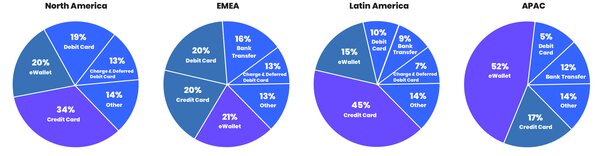

The diagram below outlines a rough division of popular payment methods across the four main regions. While the North American and EMEA regions seem similar at first glance, the differences are more profound when comparing them to the Latin American & APAC regions; While card payments are still considered a “safe bet” for merchants operating in the European & N. American markets, if a merchant wishes to approach the Chinese market, he’s up for a big disappointment.

While Westeners still use credit cards as a popular method, in China, eWallets are on the rise – both in eCommerce and POS.

The equation becomes simple – to increase profitability, merchants need to tailor their offering to the regions they wish to target.

Differences within regions

The fragmentation of payment methods doesn’t just end among the different regions. It is true that the main, clear-cut division is between east and west, but the fragmentation of local payment methods within these regions is very big. Let’s break down the main ones:

North America

Despite the rise of many new payment options globally, online payments in North America continue to be dominated mostly by credit and debit cards (34% and 19% respectively). Nevertheless, the use of eWallets, which account to 20% of online payments, continue to rise and is becoming more prominent both in online payments as well as POS.*

*WorldPay Global Payment Report (2018)

Did you know?

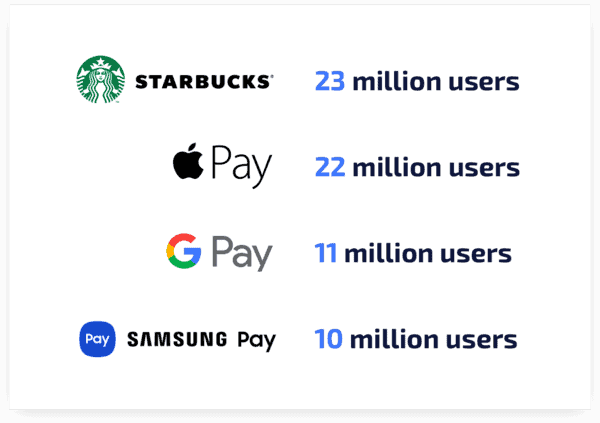

One of the most popular mobile payment apps in the US is… Starbucks! (2018)Yes, that’s right. The chart below, taken from a 2018 study by eMarketer ranks the Starbucks app as the most popular mobile payment platform in the US. With a staggering number of 23.4 million users, Starbucks beats second-placed Apple Pay (22 million) and the coffee giant is expected to maintain its lead into 2022. This information might seem amusing but shows the growing use of alternative payment methods, even in regions where the dominant methods are still credit and debit cards.

EMEA

The European, Middle East & Africa regions (EMEA) presents a very diverse market consisted of a myriad of payment methods, bank transfers

are prominent and lead eCommerce payment share in countries as diverse as Germany and Nigeria, while eWallets have become the leading payment option among Danish consumers. Payment methods are also fragmented within regions, some of which are relevant only in specific ones (e.g. Klarna in Germany, Sweden, Norway and Finland; Paypal, Jiffy and Payljb which is used almost exclusively in Germany, Croatia, and Spain). Understanding the different requirements of every region is important if merchants want to target specific populations – i.e. if your target country is Germany, then integrating the most popular payment methods in this region will have a positive effect on the willingness of clients to go through the checkout process. According to Wordpay’s Global Payment Report (2018), future payment innovation in EMEA is expected to flourish under the European Union’s Second Payment Services Directive (PSD2), which is expected to reduce profoundly fraud rates. eWallets are also expected to grow profoundly in these regions.

Did you know?

France & Sweden are leading in non-cash payments (2017) A research conducted by Forex Bonuses analyzed 20 of the world’s top economies and ranked them according to their cashless credentials. France and Sweden ranked highest in number of transactions made by using non-cash methods.

Latin America

In the Latin American Countries (LAC), many consumers are unbanked and often use their favorite cash vouchers for online payments. Others may use credit cards, but most can only be used domestically. The process usually goes as follows: The cash voucher brand is selected at checkout, a voucher is printed with a code, which is settled by one of the agent-chains, who often oversee the scheme. The vouchers often get the same branding as the store it will be used for.

To make things more complicated, the vouchers also differ from country to country. Making the payment process an even more local-centric process.

Credit cards are also a popular payment method in LAC, because almost all issuers offer installments options.

An important things merchant need to have in mind when entering a LAC country is that the majority of cards issued in those countries can only be used at domestic merchants – those for international use come with a higher annual fee. So merchants entering a LAC country from abroad will need to make the proper integration with a local acquirer. E.g. In Chile, it is necessary to be integrated with Webpay Plus in order to accept cards online.

APAC

As we’ve touched briefly in the Global vs. Local paragraph above, eWallets are growing in popularity as a more convenient and secure way of payment for commodities in many markets. In the APAC region, where the majority of the population is unbanked, and eWallets have become a go-to option for online payments (eWallets are also extensively used in physical POS as well as for money transfer purposes and more).

Just to show how much the use of eWallets is prevalent, the diagram below shows the use of eWallets in China, both for online and POS payments:

Businesses wishing to serve Chinese consumers need to recognize the growing need and make the necessary adjustments to an entirely different set of expectations. This is certainly true of eCommerce, where integrating Alipay and WeChat Pay, as well as UnionPay, the dominant Chinese card brand scheme, becomes a must.

Did you know?

The Chinese Mobile Payment Market Is 35 times bigger than its American counterpart (2017)China’s mobile payments market was worth $17 trillion in 2017, roughly 35 times more than America’s $49 billion market.

Choosing the right payment methods for your business

Even by this brief overview, the fragmentation of payment methods around the world is very noticeable and requires personal consideration when merchants wish to branch out into new geographical locations.

If a business grows gradually, then maybe merchants can afford a trial-and-error phase, to check and inspect what works for them. But if a business is rapidly growing, there is an increased urgency to get into new markets, and fast. That is why getting to know the global ecosystem is so important. This versatility might cause some confusion at first, but as long as merchants narrow down the regions they wish enter, then it’s only a matter of knowing which are the most popular payment methods in their chosen regions and then integrating them into their offering.

ZOOZ currently supports a multitude of payment methods. For a full list make sure to use this handy tool to easily search for your desired payment method/PSP.

Want to learn how to optimize your payments? contact us today to learn more.